I. Buying and selling Government bonds

II. Buying and selling foreign currency

III. Pension fund management

IV. Lending to private companies

V. Printing and distributing currency notes

Select the correct answer using the code given below:

(a) I and II only

(b) II, III and IV

(c) I, III, IV and V

(d) I, II and V

Ans-a

Explanation

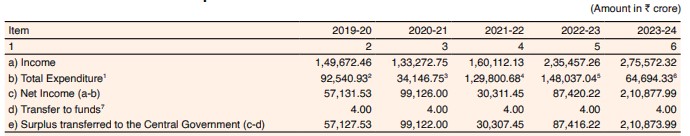

The size of the Reserve Bank’s balance sheet increased by 11.08 per cent for the year ended March 31, 2024. While income for the year increased by 17.04 per cent, expenditure decreased by 56.30 per cent. The year ended with an overall surplus of ₹2,10,873.99 crore as against ₹87,416.22 crore in the previous year, resulting in an increase of 141.23 per cent.

Trends in Income, Expenditure, Net Income and Surplus Transferred to the Central Government

RBI Expenditure

The Reserve Bank incurs expenditure in the course of performing its statutory functions by way of agency charges/commission, printing of notes, expenditure on remittance of currency, besides employee related and other expenses .

Hence 5 is incorrect

RBI Income

The components of Reserve Bank’s income are ‘Interest’ and

‘Other Income’ including

(i) Discount

(ii) Exchange

(iii) Commission

(iv) Amortisation of premium/ discount on Foreign and Rupee Securities

(v) Profit/ Loss on sale and redemption of Foreign and Rupee Securities

(vi) Depreciation on Rupee Securities inter portfolio transfer

(vii) Rent Realised

(viii) Profit/ Loss on sale of Bank’s property, and

(ix) Provision no longer required and Miscellaneous Income.

Certain items of income interest on LAF repo, Repo in foreign security and exchange gain/ loss from foreign exchange transactions

Hence 1 and 2 are correct

Pension fund management and Lending to private companies are not functions of RBI

Hence 3 and 4 are incorrect

Read: Previous Year UPSC Economy Questions (PYQs) With Explanation 2025